Mortgage trends in Edmonton

Share

Understanding Mortgages in Edmonton: A Guide for Homebuyers

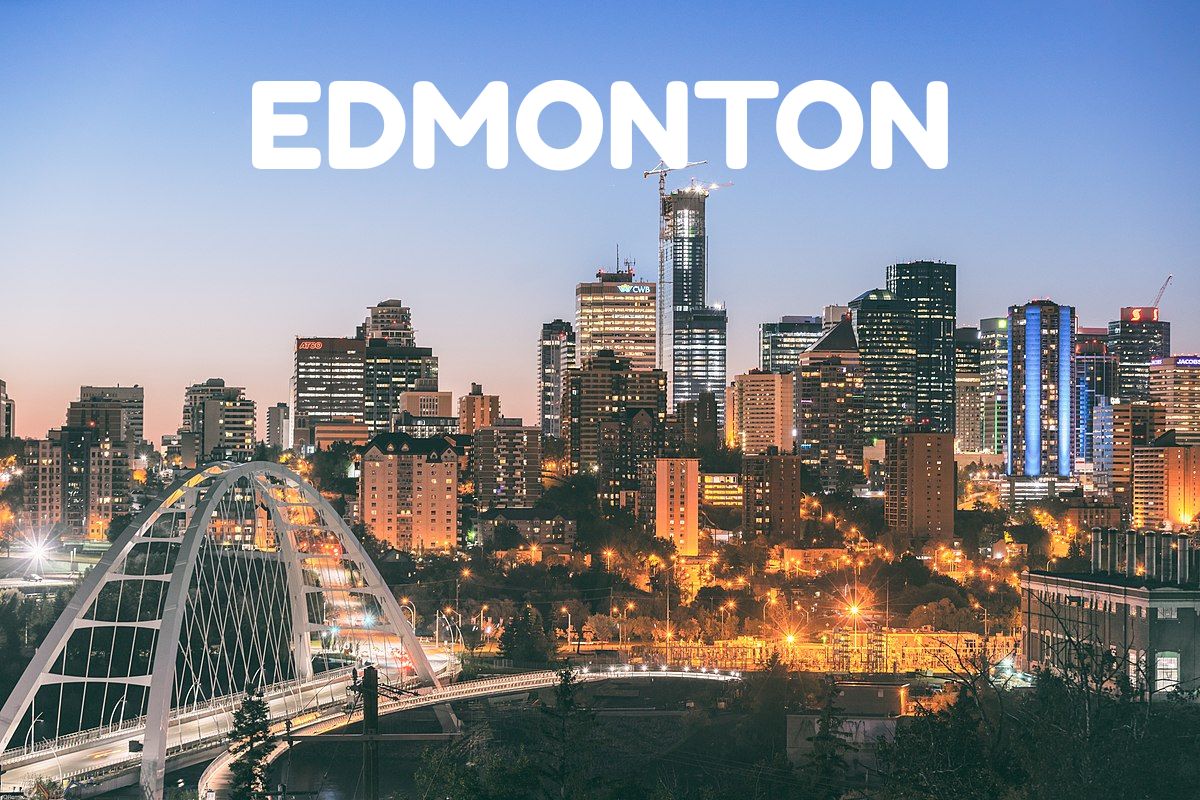

Thinking about buying a home in Edmonton? Whether you're exploring resale homes in Edmonton or looking at pre-construction homes in Edmonton, understanding how mortgages work is essential for making informed decisions.

What Is a Mortgage?

A mortgage is a long-term loan provided by a lender that enables you to purchase a home without paying the full amount upfront. In Canada, most mortgage terms are 25 or 30 years, during which you repay the loan with interest.

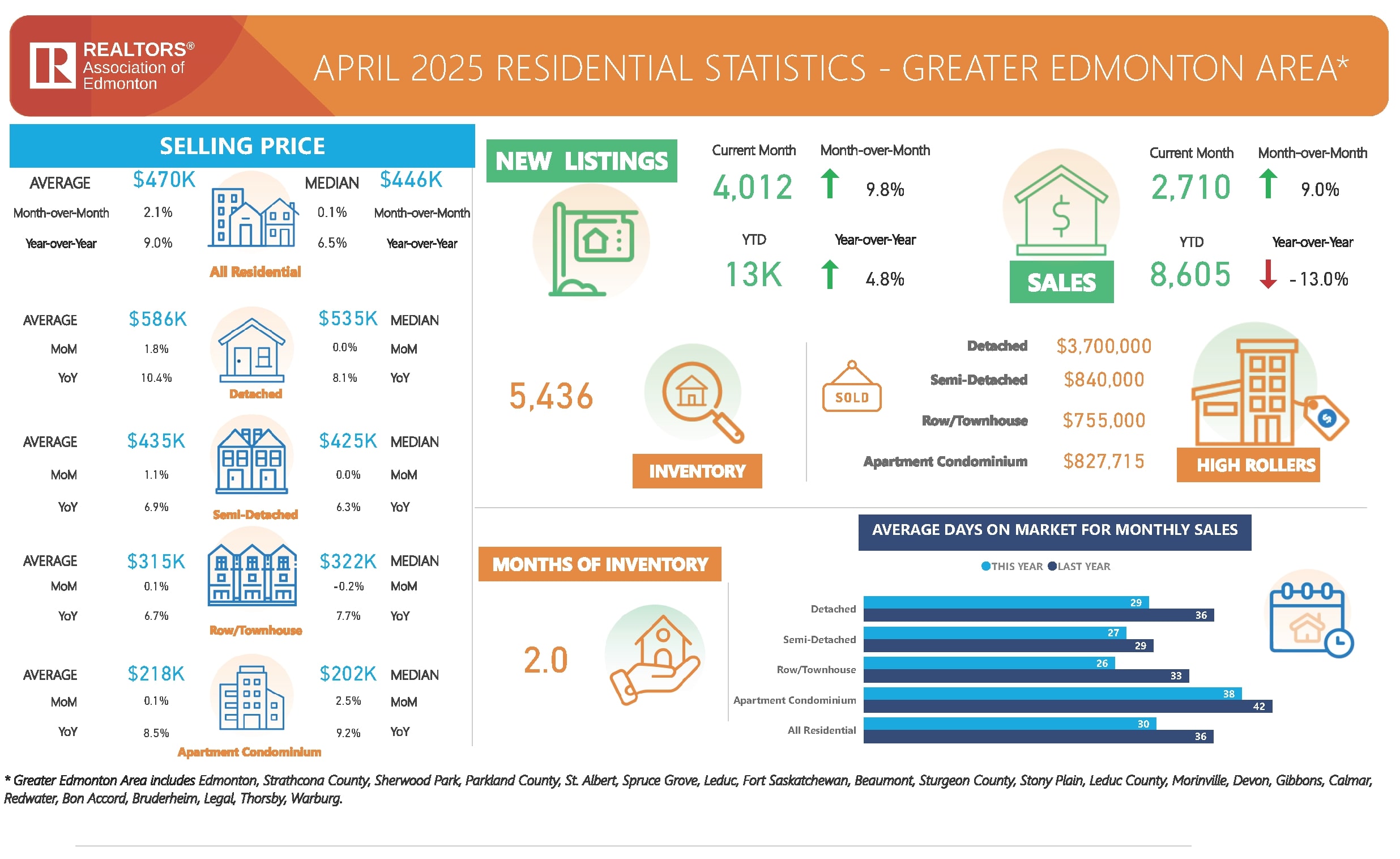

Current Mortgage Rates in Edmonton

As of July 2025, mortgage rates in Edmonton average around 5.2% for a 5-year fixed term, while variable-rate mortgages tend to be slightly lower. These rates can vary depending on inflation trends, economic factors, and your personal credit score.

Factors That Affect Your Mortgage Approval

- Credit Score: A strong score often leads to lower interest rates.

- Income & Debt: Lenders assess your income relative to current debts.

- Down Payment: At least 5% is required for properties under $500,000 in Canada.

- Employment History: A stable, verifiable income stream is key to getting approved.

Using a Mortgage to Invest in Edmonton Real Estate

With its affordability and job growth, Edmonton is a great market for both first-time buyers and investors. Many use mortgages to purchase townhomes in Edmonton, detached homes in Edmonton, or condos in Edmonton as long-term investments.

Helpful Mortgage Resources

Final Thoughts

Whether you're buying your first home or planning to move into a larger space, a mortgage is your path to owning real estate in Edmonton. Take the time to compare lenders, understand your financial profile, and don’t hesitate to work with a mortgage broker to secure the best deal. Edmonton continues to be an appealing market with upcoming projects in Edmonton that suit various budgets and lifestyles.

Sources

- Nesto.ca – Current Edmonton Mortgage Rates (July 2025)

- Ratehub.ca – Best 5-Year Fixed Mortgage Rates in Edmonton

- Nerdwallet – Alberta Mortgage Rate Comparison

- Canada.ca – Down Payment Requirements in Canada

- Canada.ca – Understanding Mortgages

- MortgageApplyOnline – Edmonton Mortgage Guide

- ATB Financial – Home Buying Guide for Alberta